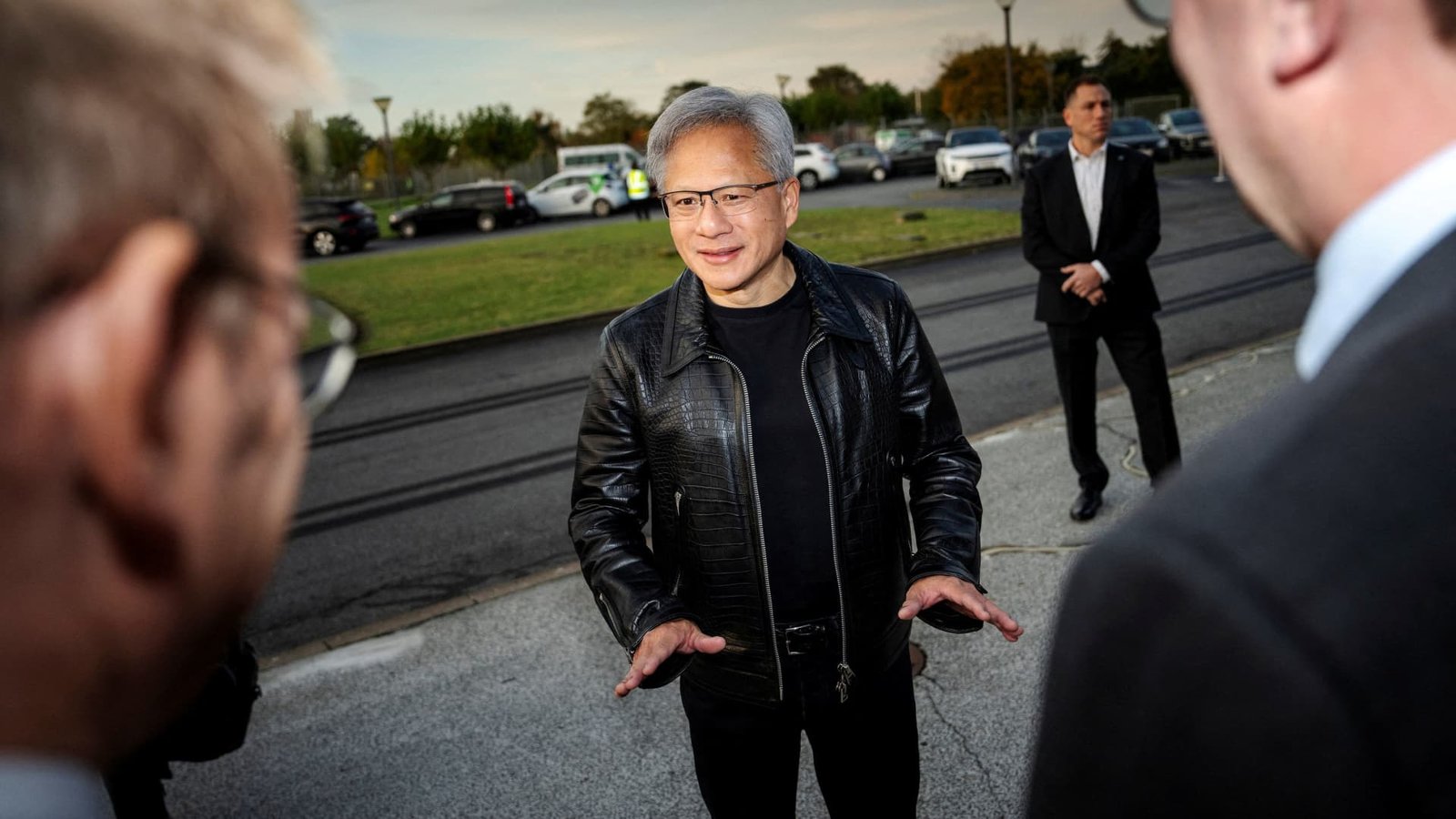

Nvidia CEO Jensen Huang arrives at the launch of the supercomputer Gefion, at the Vilhelm Lauritzen Terminal in Kastrup, Denmark, Oct. 23, 2024.

Ritzau Scanpix | Mads Claus Rasmussen | Via Reuters

Nvidia reports fiscal third-quarter earnings Wednesday after the market closes.

Here’s what Wall Street is looking for, per LSEG consensus estimates:

- Revenue: $33.16 billion

- Earnings per share: 75 cents, adjusted

How Nvidia sees the current quarter shaping up is even more important than the results. Investors want to see if the chipmaker can continue to grow at a fierce rate, even as the artificial intelligence boom enters its third year. Wall Street expects Nvidia to forecast 82 cents per share on $37.08 billion in sales.

Much of that future growth will have to come from Blackwell, its next-generation AI chip for data centers currently shipping to customers Microsoft, Google and Oracle.

Analysts will listen carefully to comments from CEO Jensen Huang to hear what he says about the demand for Blackwell. The company could also address reports that some of the systems based on Blackwell chips are experiencing overheating issues.

In August, Nvidia said it expected about “several billion” in Blackwell sales during the January quarter.

Nvidia stock has nearly tripled since the start of 2024.

The company reported a 122% growth in sales in the most recent quarter, but that was a slowdown from the 262% year-over-year growth it reported in the April quarter and the 265% growth in the January quarter.

Source link