- 0G has transitioned into a Decentralized AI Operating System (dAIOS).

- Initially, OG was a leading modular AI blockchain.

- 0G aims to democratize AI as a public good, attracting interest across various sectors.

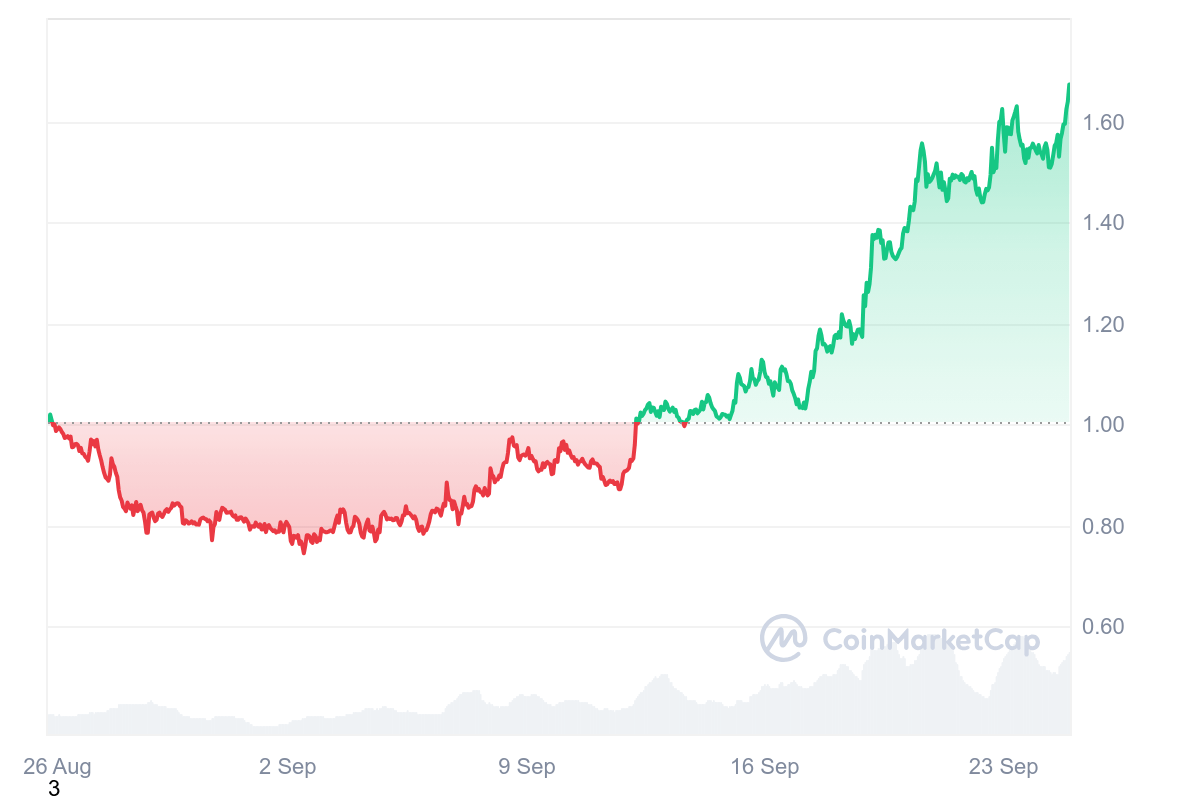

On October 1, 2024, 0G announced a groundbreaking shift in its identity, evolving from a leading modular AI blockchain to the world’s first Decentralized AI Operating System (dAIOS).

This transformation underscores 0G’s commitment to decentralizing artificial intelligence and providing users with complete control over their data while promoting transparency, monetization, and incentive alignment.

Decentralizing AI workflows

In today’s highly centralized AI landscape, data ownership and decision-making processes often lack clarity. 0G aims to change that by leveraging blockchain technology to coordinate distributed hardware resources such as storage, computation, and data availability.

This innovative approach enables scalable, transparent, and auditable AI infrastructures that integrate seamlessly into various workflows.

The architecture of 0G comprises modular components including 0G Storage, 0G Data Availability (DA), and 0G Serving. Each of these components is designed to cater to distinct aspects of AI workflows, facilitating efficient management of vast data loads and real-time interaction with decentralized AI applications.

For instance, 0G Storage utilizes erasure coding to secure data while maintaining accessibility, all managed by incentivized miners through a unique consensus mechanism known as Proof of Random Access (PoRA).

With throughput speeds of 50 GB/second, 0G is positioned to outperform competitors by a staggering 50,000 times at 100 times lower cost. This capability makes on-chain AI applications feasible, addressing critical issues such as ownership, transparency, monetization, and alignment that plague centralized AI systems.

0G’s mission is to democratize AI

Looking ahead, 0G’s mission is to democratize AI as a public good, fostering an extensive ecosystem that encompasses various sectors including gaming and decentralized finance (DeFi).

The platform’s rapid scalability and efficient data management solutions are already attracting significant interest from key players in the Web3 space.

As 0G continues to advance its dAIOS infrastructure, it stands at the forefront of the decentralized AI revolution, committed to reshaping the future of technology and data management.

Source link