Nvidia shares moved lower Wednesday evening despite another beat-and-raise quarter. Simply put, the leading maker of AI chips again fell victim to the curse of high expectations. That’s not a concern to us, though, because Nvidia’s underlying fundamentals and long-term outlook appear to be as healthy as ever. Revenue surged 94% year over year to a record $35.08 billion, easily outpacing the $33.16 billion the Street was looking for, according to estimates compiled by data provider LSEG. Adjusted earnings per share more than doubled to 81 cents, exceeding the consensus estimate of 75 cents, LSEG data showed. Current quarter guidance for revenue and gross margin was also ahead of expectations, though clearly not the magnitude the most bullish of investors were hoping for (let them sell, more for us). The stock fell nearly 2% in extended trading, to roughly $143 apiece. Shares of Nvidia, the world’s most valuable company, concluded Wednesday’s session up nearly 42% since their most-recent low in early September. That marked the end of an unnecessarily steep sell-off in response to its late August earnings report. NVDA YTD mountain Nvidia’s year-to-date stock performance. Bottom line Nvidia reported a fantastic quarter Wednesday — even if guidance for the current quarter came up a bit short of the loftiest expectations, weighing on shares. It’s hard to complain about a beat-and-raise quarter just because the beat and raise wasn’t as big as some craved. Nvidia’s earnings call made it clear that we’re very much in the early innings of an artificial intelligence revolution that will fuel demand for Nvidia’s market-leading chips well into 2025 and likely well beyond that. We’re reiterating our 1 rating and upping our price target on the stock to a $165 a share, up from $150. Commentary Nvidia’s next-generation AI chip Blackwell is in “full production,” CFO Colette Kress said. And it is ramping up into fiscal 2026, which begins in earnest in February. Customers are hungry for the chips. “We will be shipping both [current-generation] Hopper and Blackwell systems in the fourth quarter of fiscal 2025 and beyond,” Kress said in written remarks. “Both Hopper and Blackwell systems have certain supply constraints, and the demand for Blackwell is expected to exceed supply for several quarters in fiscal 2026.” Some investors may consider the supply crunch disappointing because it means money is being left on the table, at least into the middle of next year. But we’re not fretting. This is almost certainly a dynamic in which sales are pushed out, rather than lost completely. For that reason, any material pullback in Nvidia shares driven by these constraints is buyable – that’s the advantage of being a long-term focused investor. Ultimately, the Blackwell orders will be fulfilled, and given the company’s efforts to update product lines on an annual basis, we’ll already be hearing about the next-generation chips by the time supply catches up with demand. CEO Jensen Huang was not surprisingly asked about a recent media report that said a certain configuration of Blackwell chips was overheating. Huang was about as dismissive as he could be – not that he was deflecting the question, necessarily. His answer made it seem like he just wasn’t seeing the issue. He emphasized just how advanced Blackwell is, both in the complex manufacturing process and the act of actually getting them installed within data centers “That integration process [with customers’ specific data centers] is something we’ve done several generations now. We’re very good at it,” Huang said. “But still, there’s still a lot of a lot of engineering that happens at this point. … As you see from all of the systems that are being stood up, Blackwell is in great shape.” Nvidia Why we own it : Nvidia’s high-performance graphic processing units (GPUs) are the key driver behind the AI revolution, powering the accelerated data centers being rapidly built around the world. But this is more than just a hardware story. Through its Nvidia AI Enterprise service, Nvidia is in the process of building out a potentially massive software business. Competitors : Advanced Micro Devices and Intel Most recent buy : Aug 31, 2022 Initiation : March 2019 Huang pushed back on another budding worry in the investment community: Is the quality of AI models not improving as much as previously expected despite added computational firepower? It’s what is known in the tech industry as “scaling.” Think of it as basically hitting some ceiling in which larger data centers with more GPUs doesn’t yield all that much of an improvement in model capabilities – at least, not enough to justify all the extra spending on the latest and greatest hardware. Perhaps one day that will be the case, but, according to Huang, it doesn’t appear to be an issue any time soon. When analyzing a particular AI model, Huang said there are essentially three distinct phases in which it can become more advanced thanks to a greater quantity of increasingly powerful chips: 1) the initial “pre-training” phase 2) the refinement process where fine-tuning adjustments take place 3) real-world usage known as inference. The CEO argued that as the availability of Blackwell increases and customers are able to tap into its performance advancements versus Hopper, there should be a noticeable improvement in model quality at each phase. He noted that the current generation of so-called foundation models — essentially, these are large, general-purpose models — are utilizing around 100,000 Hopper chips. Now, as we start this next generation, we’ll be seeing models run on 100,000 Blackwell chips — and scaling is still in effect. Huang’s argument is that going beyond 100,000 Blackwell chips will yield even more capable models. The positive implication for Nvidia shareholders is that its customers are almost forced to buy more, or be at risk falling behind its competitors that do. Huang also quieted concerns about a looming “digestion phase” following the Hopper-to-Blackwell transition. That is when customers temporarily pull back on orders, enabling them to harvest profits and generate a real return on the investments they’ve made into existing computing infrastructure. It’s a fair question to ask because Nvidia’s stock has historically taken a pretty big hit when its customers – such as cloud-computing providers – start uttering that phrase. “I believe that there will be no digestion until we modernize $1 trillion of the data centers,” Huang said, adding: “If you just look at look at the world’s data centers, the vast majority of it is built for a time when we wrote applications by hand and, and we ran them on CPUs.” The modernization that Huang refers to is about GPU-focused data centers, geared toward a world of AI-written software. Nvidia also continues to see momentum on sovereign AI as countries embrace its chip technology “for a new industrial revolution powered by AI,” said finance chief Kress. This is a growing market for Nvidia that helps broaden its customer base far beyond U.S. tech giants such as Microsoft, Meta Platforms and Amazon. Add all these dynamics up — supply constraints, scaling still intact, outdated centers and an expanding customer pool — and it becomes crystal clear that selling Nvidia’s stock based on its three-month guidance is the wrong approach. Investors will be better served by owning shares for the long haul, rather than trying to trade in and out of every swing in the stock price. Guidance Taking a closer look at guidance, Nvidia’s fiscal fourth quarter outlook looks good versus consensus analyst estimates. However, investors have come to expect that — guiding ahead of expectations is the bare minimum for this company. In the days ahead, expect Wall Street to debate whether the magnitude of the better-than-expected outlook justifies the stock making a move back to its all-time closing high of nearly $149 a share. It’s worth repeating: Nitpicking whether management’s outlook for the next three months, especially during a major production ramp, is not how you maximize your long-term upside. Instead, focusing on the underlying trends reveals a company with a massive runway for growth ahead of it. Revenue of $37.5 billion, plus or minus 2%, ahead of the $37.1 billion consensus estimate. That implies a year-over-year growth rate of approximately 70%. Adjusted gross margins are expected to be 73.5%, plus or minus 50 basis points, slightly ahead of estimates of the 73.3% estimate. Going forward, margins will continue to be Expectations for adjusted operating expenses in the fiscal fourth quarter of $3.4 billion appear to be slightly ahead of expectations of about $3.2 billion. Looking out a bit further, management said it’s reasonable to assume that Nvidia’s gross margin percentage will return to the mid-70s by the back half of calendar year 2025. To be sure, executives explained that it will depend on the path of the Blackwell ramp and the company’s sales mix. (Jim Cramer’s Charitable Trust is long NVDA. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

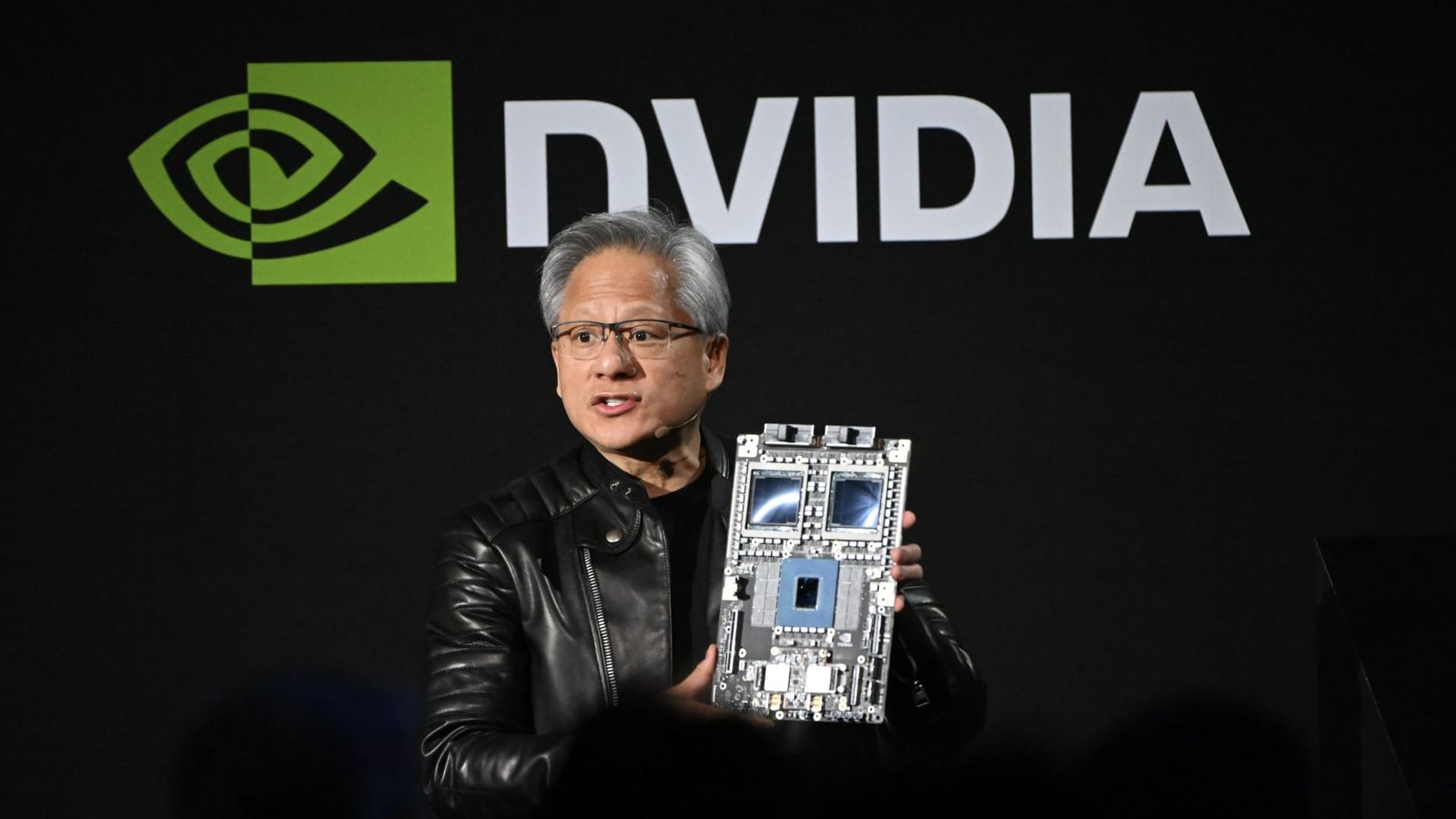

Jensen Huang, co-founder and chief executive officer of Nvidia Corp., holds up the company’s AI accelerator chips for data centers as he speaks during the Nvidia AI Summit Japan in Tokyo, Japan, on Wednesday, Nov. 13, 2024.

Akio Kon | Bloomberg | Getty Images

Nvidia shares moved lower Wednesday evening despite another beat-and-raise quarter. Simply put, the leading maker of AI chips again fell victim to the curse of high expectations. That’s not a concern to us, though, because Nvidia’s underlying fundamentals and long-term outlook appear to be as healthy as ever.

Source link